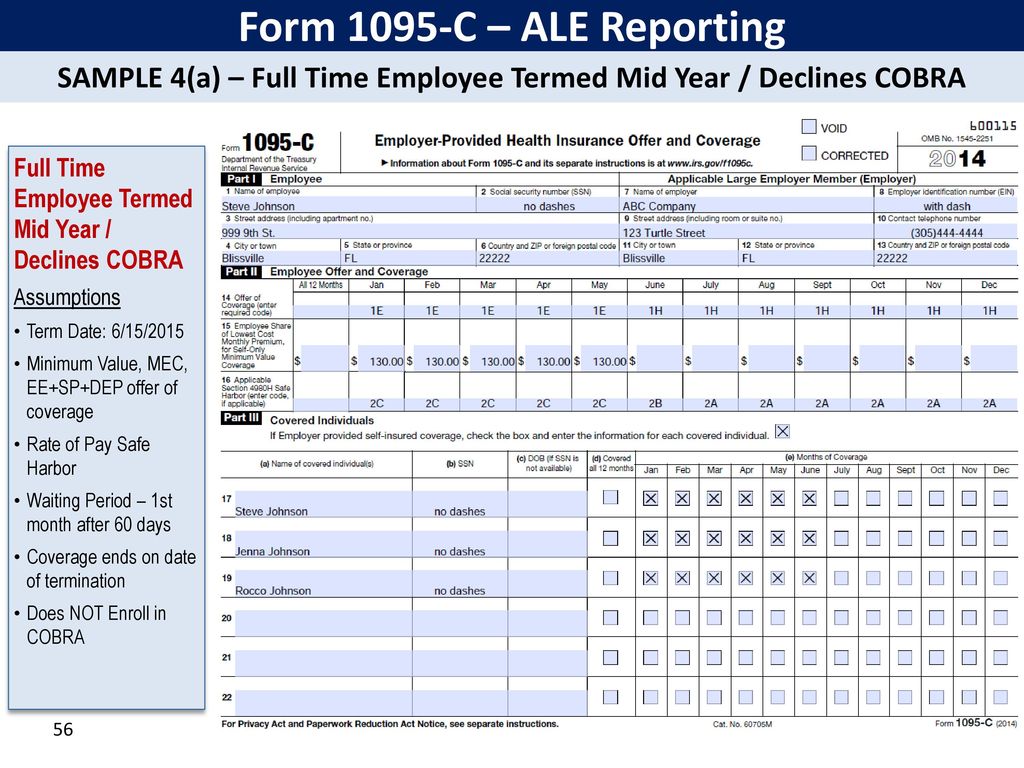

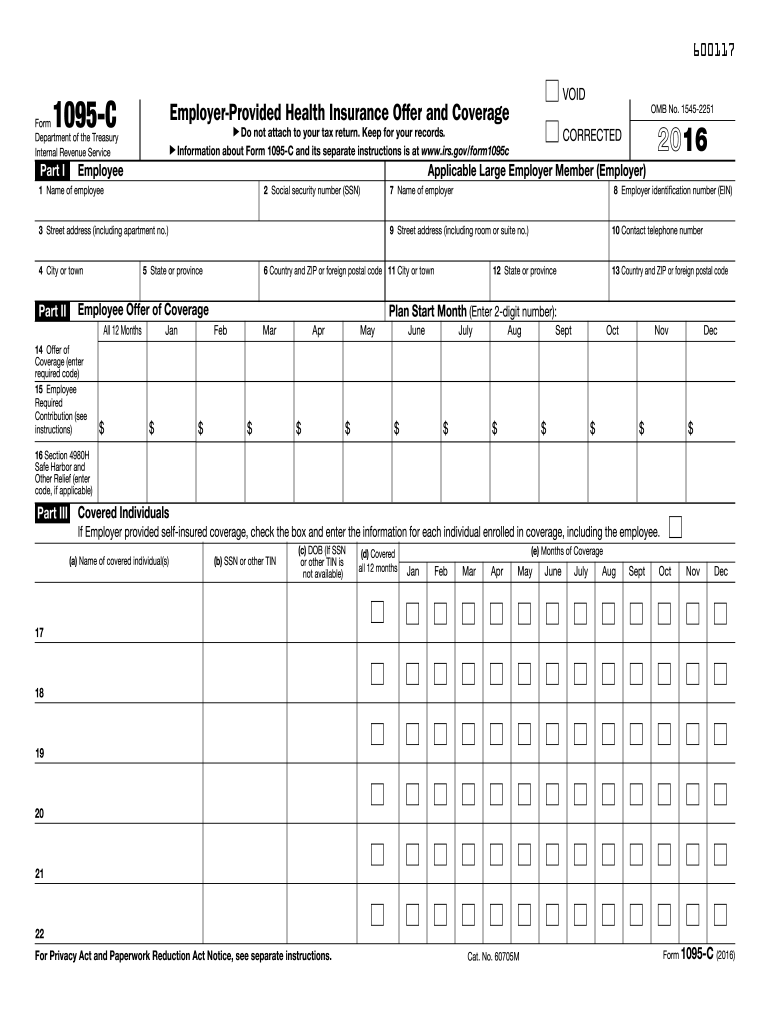

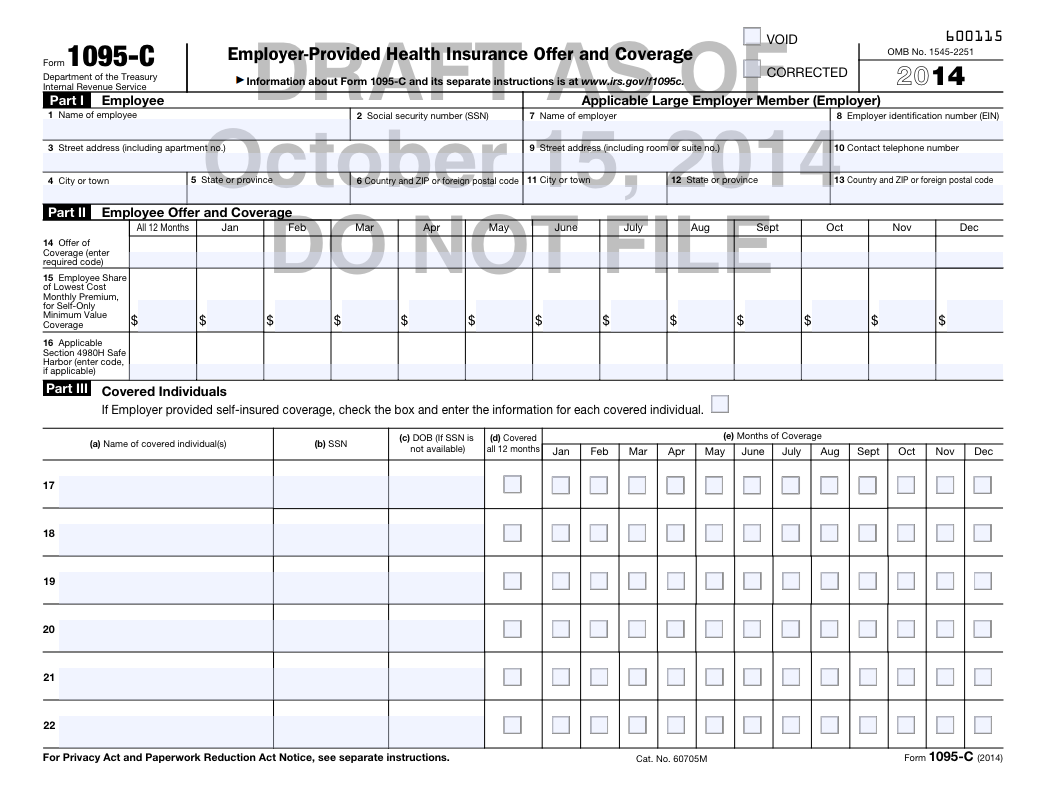

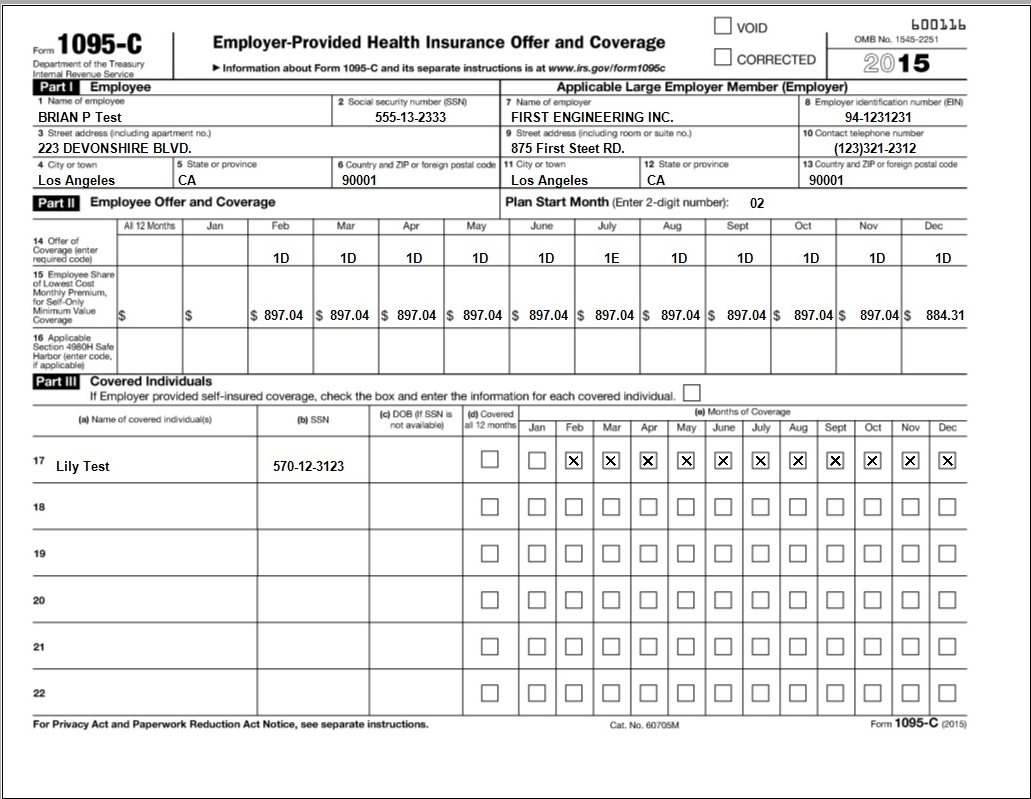

Sample 1095C Documents The following examples assume your company's health benefits meet minimum value, are not part of a qualifying offer outlined in 1A above, and are offered unconditionally to both spouses and dependent children Each employee situation is different, and your 1095C form may not match any of the examples belowThe Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer ofApplicable Large Employers (for example, you left employment with one Applicable Large Employer

Common 1095 C Coverage Scenarios With Examples Boomtax

How to request form 1095-c

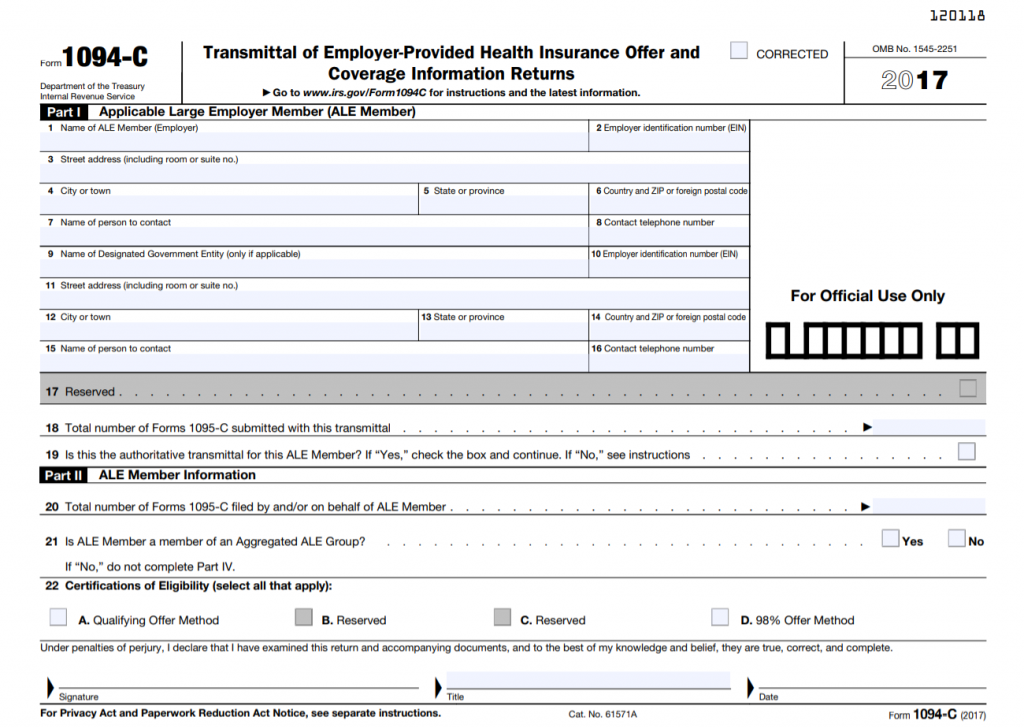

How to request form 1095-c- · For example, if an employer intends to file a separate Form 1094C for each of its two divisions to transmit Forms 1095C for each division's fulltime employees, one of the Forms 1094C filed must be designated as the Authoritative Transmittal and report aggregate employerlevel data for both divisions, as required in Parts II, III, and IV of Form 1094CApplicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer) In that situation, each Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the form

Ez1095 Software How To Print Form 1095 C And 1094 C

Data, put and ask for legallybinding electronic signatures Do the job from any gadget and share docs by email or fax Check out now!The second page is the actual 1095 C fillable Form, which will show the amount of the premium you paid for the coverage you chose Why Does Receiving the IRS Form 1095 C Matter This healthcare marketplace Form 1095 C is important because it proves you were receiving a government benefitFullTime Employee Hired Midyear, Qualifying offer;

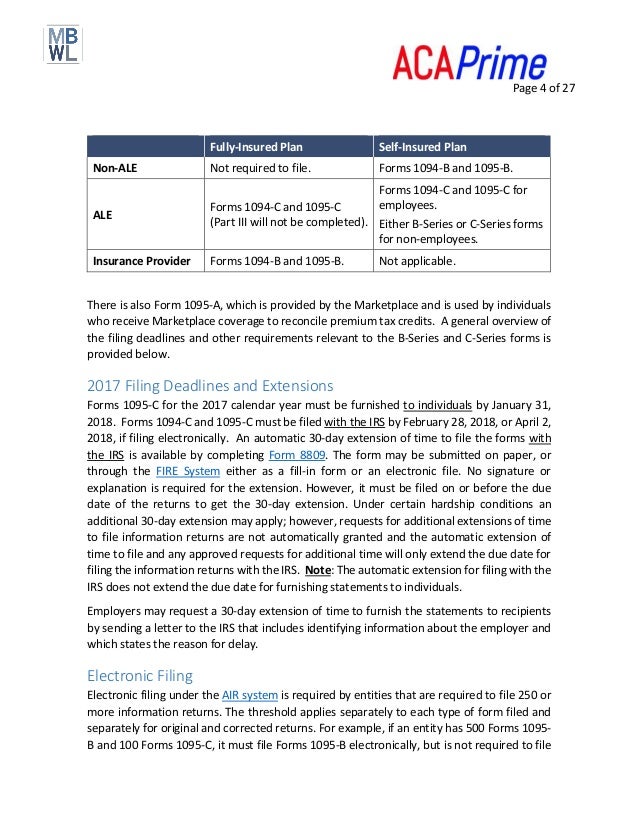

An employee must receive a 1095C form whether or not they make use of the employer's health plan Where the 1094C Fits In While Form 1095C is sent to both employees and the IRS, Form 1094C is only provided to the IRS The following information must be included on Form 1094C Information about the employer (address, employer identificationForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax creditThe Form 1095C RTF file (for the printed Form 1095C's) The XML XSL (XML transformation file used to map to the IRS XML schema) when creating the target (final) XML file for electronic filing Ensure that you use the same alias names used by JD Edwards or the mapping of information fails and the information is left blank or empty on the form and the target XML file sent to the IRS

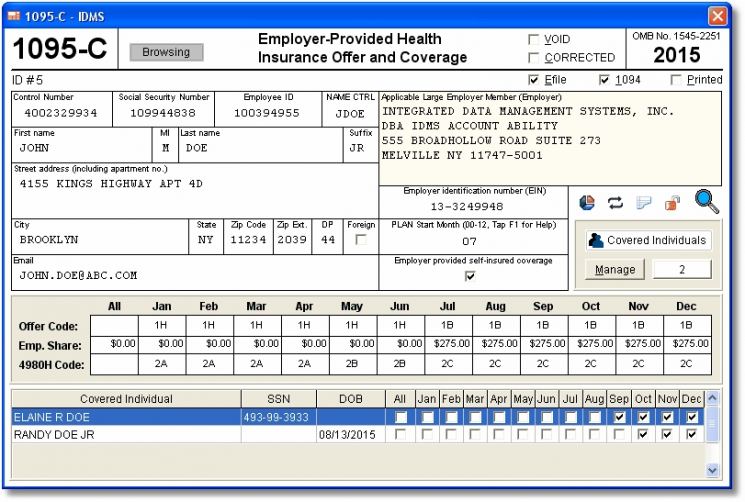

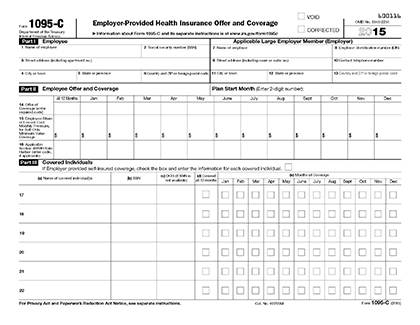

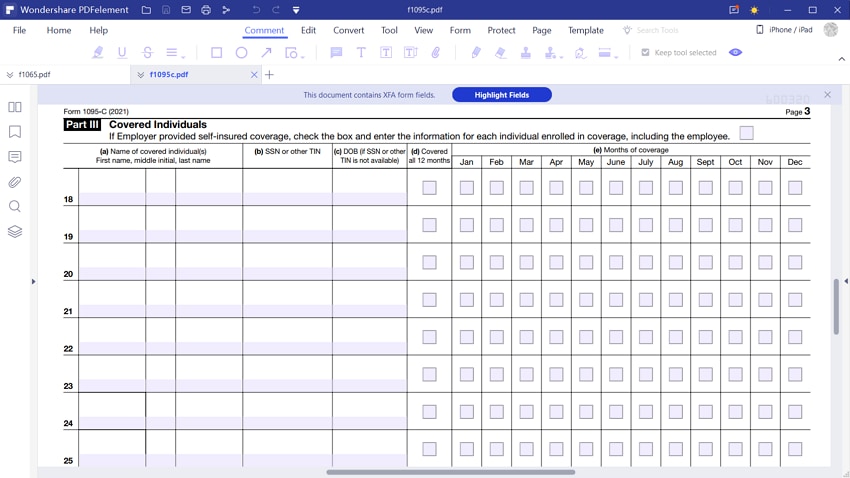

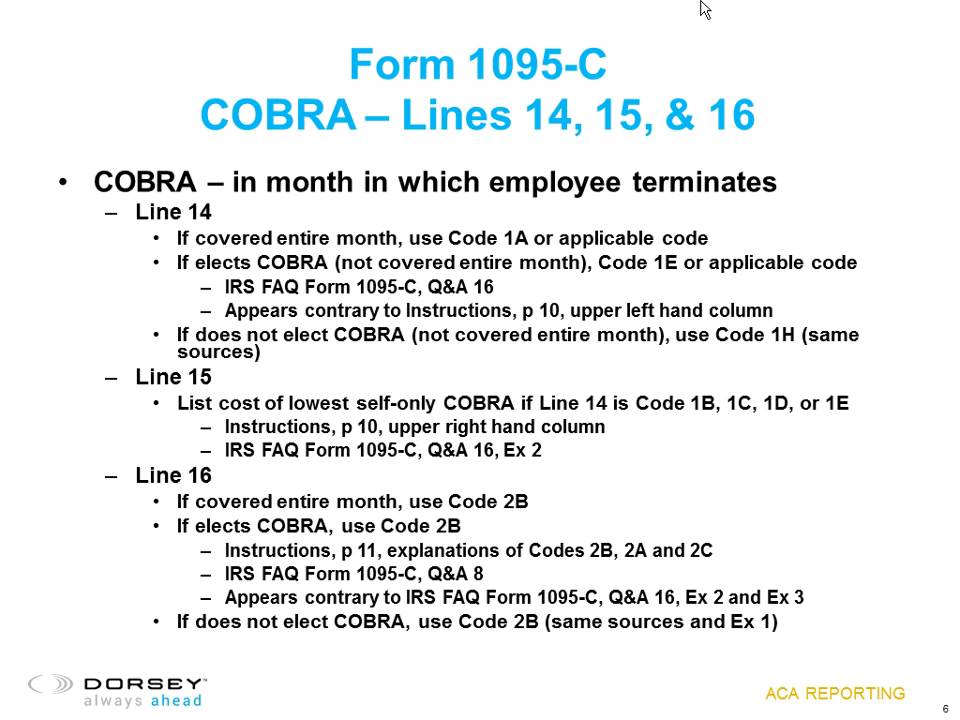

FullTime Employee Hired Midyear;1095 C Form Sample Labor Contract Form Meaning 1095 C Form 18 Value Stream Map Symbols And Meaning Visio Flowchart Shapes Meaning Revocable Living Trust Agreement Meaning Form 1099 Best Of Instructions For Form 1099 Misc 17 Form 1500 Health Insurance Claim Form W2 Form IrsgovForm 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN) Part II of the IRS Form 1095C includes three significant items Lines 14, 15 & 16 These lines together paint a

Aca Reporting Tip 16 Line 16 Union Employees Usi Insurance Services

Overview Of 1095c Form

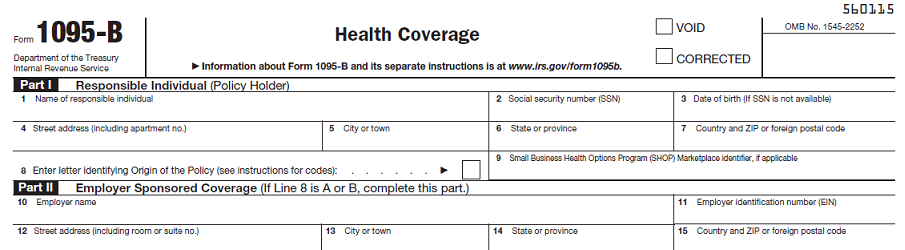

The individual identified in Part I of the Form 1095C was not an FTE for even a single month during the year, but was enrolled in selfinsured coverage for at least one day Lockton Comment Examples include covered parttime employees, partners, nonemployee directors, independent contractors, retirees, and persons purchasing COBRA coverageIn certain cases, those employers are not required to furnish a copy of the form 1095C This chart, which is taken from the instructions for forms 1094C and 1095C, list the examples of information that must be corrected on the original form 1095C filed with the IRS and furnished toForm 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

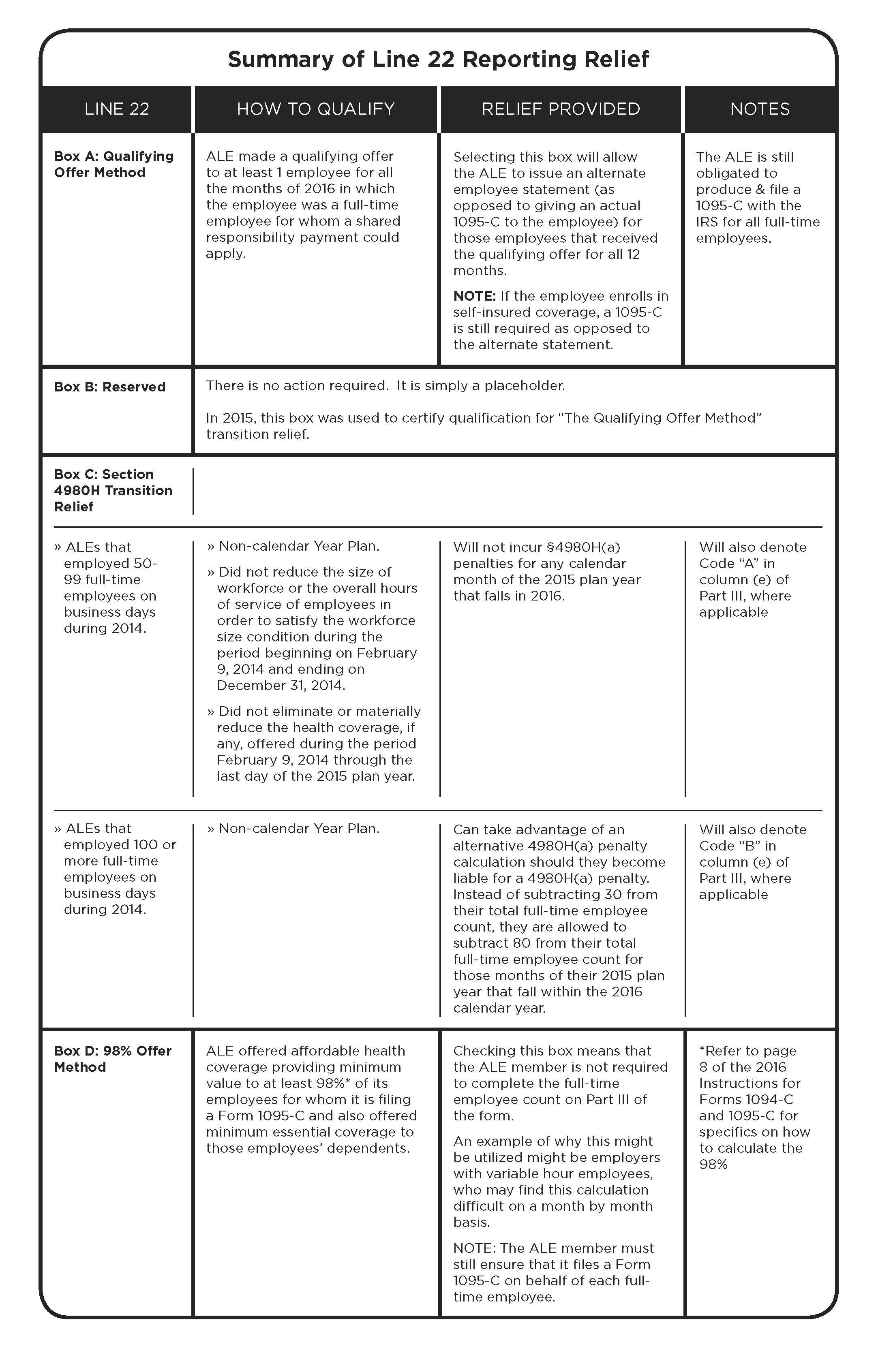

John Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning CircleFullTime Employee Waived Coverage All 12 Months; · A An employer that is eligible for the Qualifying Offer Method Transition Relief for any employee who receives a Qualifying Offer for all 12 months of the calendar year may, in lieu of furnishing the employee a copy of Form 1095C, furnish a statement as described in "Alternative Method of Furnishing to Employees Under the Qualifying Offer Method" section in the 1094 and 1095C

Accurate 1095 C Forms A Primer Erp Software Blog

United Benefit Advisors Home News Article

PartTime Employee Becomes FullTime MidyearLine 16 Codes of Form 1095C, Safe Harbor IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability Click here to learn more about ACA Form 1095C Line 16 CodesThe individual does not need to send Form 1095

Sample 1095 C Forms Aca Track Support

Ez1095 Software How To Print Form 1095 C And 1094 C

· As with most IRS forms, the Form 1095C acts as a way for the employer to report the health coverage that an employer made available to each employee Specifically, the form identifies the employee/employer relationship, what months the employee was eligible for coverage, and the cheapest monthly premium available to the employee under the plans offeredInst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095CThe draft 19 instructions for both the 1095B and 1095C remain the same as the 18 instructions, except for two numerical changes (i) increasing the maximum penalty for failing to file correct information returns or furnish correct payee statements to $3,339,000 (from $3,275,500 in 18), and updating examples with the correct year;

Aca And The Vista Hrms Fall Update

Aca And The Vista Hrms Fall Update

2 Understanding ACA Form 1095C Line 14 and 16 Codes One of the essential aspects of Form 1095C is understanding how to communicate information regarding employees' coverage To do this, Employers will need to use Code Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review theLet's Look At The Most Common 1095C Coverage Scenarios1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a month

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Forms 1095C those employees You will receive a copy of Form 1095C because you were a fulltime employee for all or some months of the prior calendar year You are receiving a copy of the Form 1095C so you know what information has been reported to the IRS about the offer of health coverage made to you and your familyForm 1095 is sent to the individual by whoever provides them with health insurance, be it the health insurance marketplace for Form 1095A, a small selffunded group or small business for Form 1095B, or by their (50 fulltime employees) employer for Form 1095C Form 1095 is only sent to the individual and for his or her own reference; · The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage,

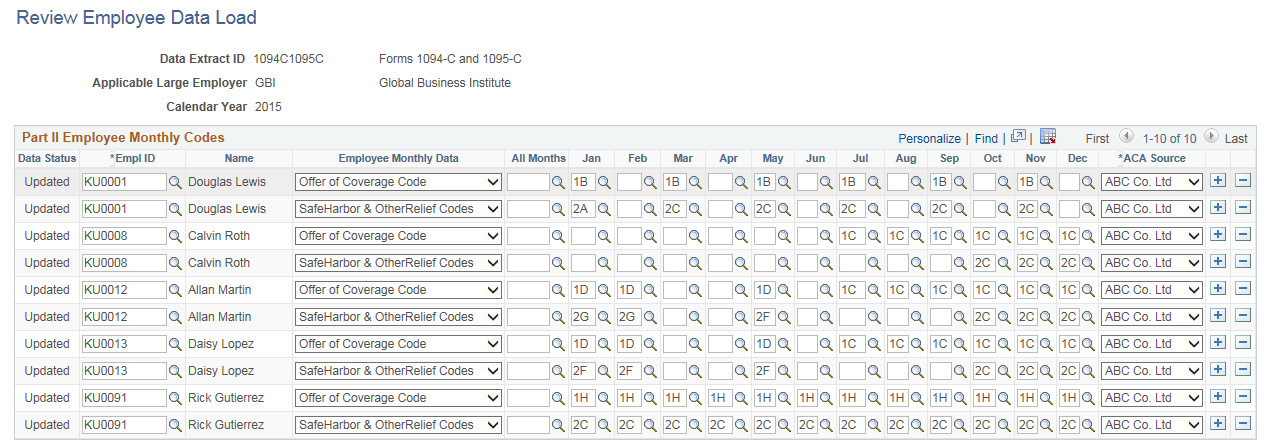

Creating Aca Form Data For Forms 1094 C And 1095 C

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095c examples Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Turn them into templates for multiple use, add fillable fields to gather recipients?Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to Form1095C Colorado State University Colorado State University provides employees with the 1095C tax form/10/ · Form 1095C is the IRS form employers provide to their employees detailing employerbased health coverage they received during that calendar year Every applicable large employer (ALE) needs to furnish a Form 1095C to each employee with information about their medical benefits for reporting purposes

Account Ability S Aca 1095 B 1095 C Compliance Software Has Been Released Integrated Data Management Systems Inc Prlog

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Forms 1095C and 1094C Form 1095C has two purposes 1 Establish the employer's compliance with the Employer Mandate 2 Provide information that will be used by the IRS in determining whether an individual is eligible for premium assistance when obtaining coverage through a Marketplace and will assist the IRS · Common 1095C Coverage Scenarios FullTime Employee Enrolled all 12 Months, qualifying offer;FullTime Employee Enrolled All 12 Months;

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Form 1095 C Guide For Employees Contact Us

· The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby youIn most cases, you do not need to wait for the Form 1095C in order to file your US Individual Income Tax Return (IRS Form 1040, 1040A, or 1040EZ) Most employees will know whether they had health coverage for a month and can simply check a box on their tax return to attest that they, their spouse (if filing jointly), and any eligible dependents had "minimum essential coverageCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 1095C

Ez1095 Software How To Print Form 1095 C And 1094 C

Sample 1095 C Forms Aca Track Support

Sample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19Form 1095C is socalled EmployerProvided Health Insurance Offer and Coverage, which updated in Tax Year 16 It is a definitely useful form to report the health insurance coverage or other related information of any employee of an ALE, Applicable Large Employers, member, who is a fulltime employee for one or more monthsAnd (ii) changing the affordability threshold

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Form 1095 A 1095 B 1095 C And Instructions

· In March, you will receive your 1095C form The form can also be used to complete a person's tax return He recalled that an FTA member should only be interested 1 type of health form is a health tax Next calendar year, you may need to complete both your personal tax return 1095c information to prepare the tax return · 1095 C Form Example October 13, 18 by Mathilde Émond 24 posts related to 1095 C Form Example Aca Form 1095 C 1095 C Form 16 1095 C Form 17 1095 C Form 19 1095 C Form Deadline 1095 C Form Instructions 1095 C Form Meaning 1095 C Form Turbotax Aca Form 1095 CodesHow to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it works

1095 C Faqs Mass Gov

Common 1095 C Coverage Scenarios With Examples Boomtax

62 Review and update Form 1094C before mailing or efiling forms to IRS Note IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page; · Form 1095‐C Examples Revised October 3, 3018 Gallagher Benefit Services ALE1 Webinar Presentation Part II Examples (10‐3‐18) IRS Reporting Resource Guide Examples for VEHI Members Example 1FORM 1095C, LINES 14 16, CODING EXAMPLES Listed, below, are Form 1095C coding directions for various scenarios For purposes of these scenarios, we will assume that, pursuant to its enrollment guidelines, the city or town provides coverage to an ACA fulltime employee on her/his first day of employment and terminates

Irs Form 1095 C Fauquier County Va

1094 C 1095 C Software 599 1095 C Software

· When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095C · 61 Form 1095C must be provided to the IRS by March 31, 17 (filing electronically) Form 1095C must provided to the IRS by Feb 28, 17 (filing paper) 62 I am probably going to need an extension on that one too 62 63 Form 09 is for you then 63 64Form 1095C Consent tab is displayed under Affordable Care Act on the lefthand navigation of the Benefit Details page Image Form 1095C Consent Page (Fluid) This example illustrates the fields and controls on the Fluid User Interface of the Form 1095C Consent page

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Important Information For Your 16 Taxes Regarding Health Coverage And Form 1095 B Or C The New York City District Council Of Carpenters Benefit Funds

1095 C Form 18 Awesome Examples Resumes 17 Basic Resume Model Gallery Resume Format Models Form Ideas

Sample 1095 C Forms Aca Track Support

Form 1095 A 1095 B 1095 C And Instructions

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

Form 1095 A 1095 B 1095 C And Instructions

Sample Of 1095 C

What Payroll Information Prints On Form 1095 C To Employees

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Know The Basics Form 1095 C Justworks

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Benefits 1095 C

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Application Prototyping In Excel 1095 C Beyond Excel

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

.png)

What Payroll Information Prints On Form 1095 C To Employees

Understanding Your 1095 C Documents Aca Track Support

Sample 1095 C Forms Aca Track Support

New Tax Document For Employees Duke Today

Your 1095 C Tax Form My Com

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

1095 C Form Official Irs Version Discount Tax Forms

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Irs Form 1095 C The Best Way To Fill It Out

Annual Health Care Coverage Statements

1095 C Faqs Office Of The Comptroller

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Form 1095 C Codes Explained Integrity Data

Sample Print Of 1095 B And 1095 C 1095 Software

Aca Reporting Penalties Abd Insurance Financial Services

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Where Do I Find My 1095 Tax Form Healthinsurance Org

Sample 1095 C Forms Aca Track Support

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Common 1095 C Coverage Scenarios With Examples Boomtax

Ez1095 Software How To Correct 1095 C And 1094 C Form

Form 1095 C Instructions Line By Line 1095 C Instruction Explained

1094 B 1095 B Software 599 1095 B Software

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Reporting Tackling Complex Form 1095 C Situations And Preparing For Form 1094 C Youtube

1095 C Print Mail s

Form 1095 A 1095 B 1095 C And Instructions

Payroll Aca Reporting Rda Systems

1094 C 1095 C Software 599 1095 C Software

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Code Series 2 For Form 1095 C Line 16

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Aca Code Cheatsheet

Aca Reporting Faq

Sample 1095 C Forms Aca Track Support

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

1095 C Eemployers Solutions Inc

Mbwl Employer S Guide To Aca Reporting